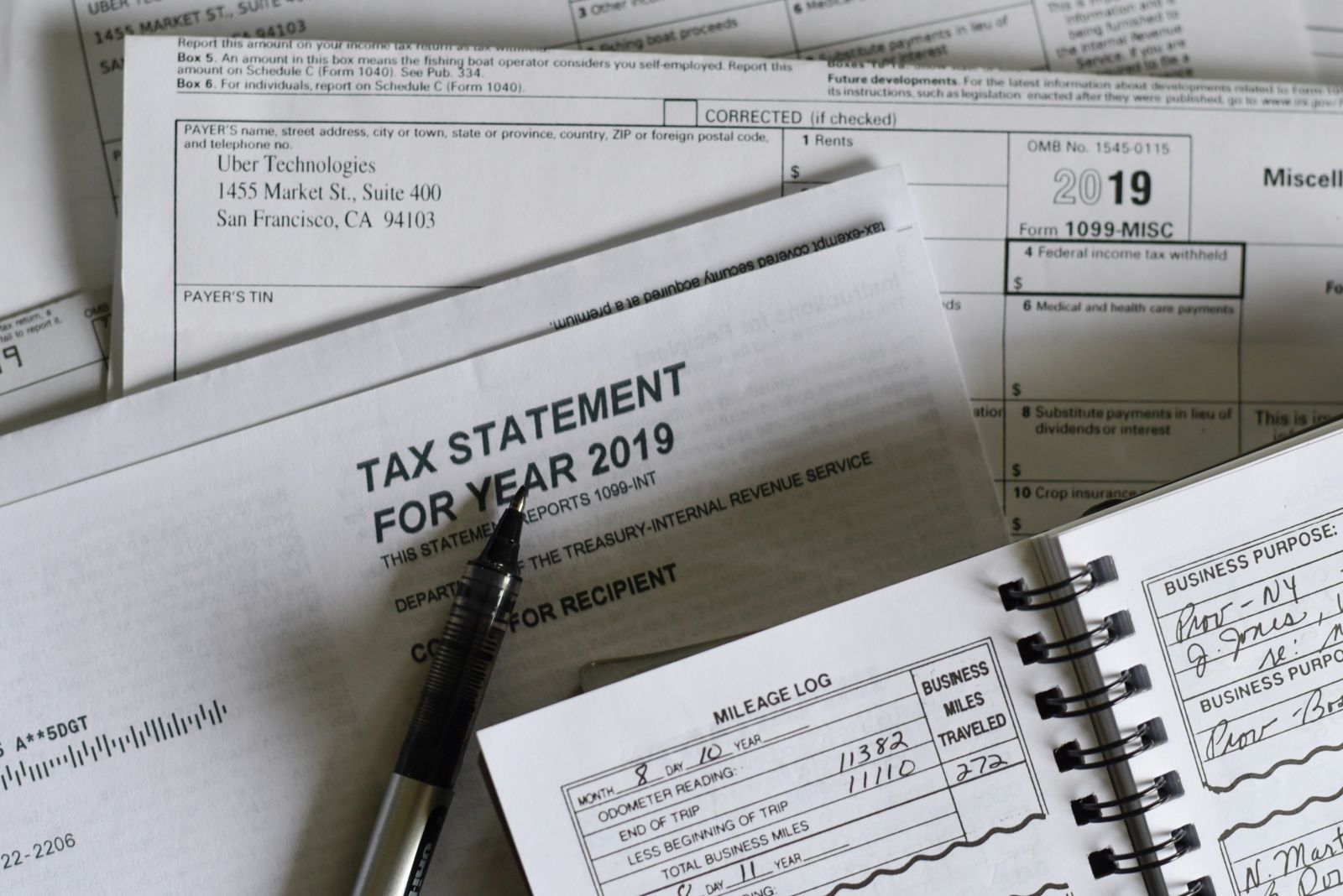

[TAX UPDATE] Continuation of VAT Reduction from 10% to 8% for Certain Goods and Services until June 30, 2025

Views: 2588

On December 31, 2024, the Government issued Decree 180/2024/ND-CP, which outlines the policy of reducing value-added tax (VAT) in accordance with Resolution 174/2024/QH15.

The key provisions are as follows:

VAT Reduction

Goods and services currently subject to a 10% VAT rate will continue to benefit from a reduced rate of 8%, with the following exceptions:

-

Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and prefabricated metal products, mining products (excluding coal mining), coke, refined petroleum, and chemical products. Detailed information is provided in Appendix I of Decree 180/2024/ND-CP.

-

Goods and services subject to special consumption tax. Detailed information is provided in Appendix II of Decree 180/2024/ND-CP.

-

Information technology products and services as defined by the law on information technology. Detailed information is provided in Appendix III of Decree 180/2024/ND-CP.

Reduction for Business Establishments

Business establishments, including business households and individual businesses, that calculate VAT using the percentage method on revenue will have the percentage rate reduced by 20% when issuing invoices for goods and services eligible for the VAT reduction.

This Decree takes effect from January 1, 2025, and will remain in force until June 30, 2025.

![?️ [ALTAS TALK IS COMEBACK | SERIES: “TAX MATTERS 2025”] ?️ [ALTAS TALK IS COMEBACK | SERIES: “TAX MATTERS 2025”]](thumbs/210x144x1/upload/news/altas-talkintro-7705.png)