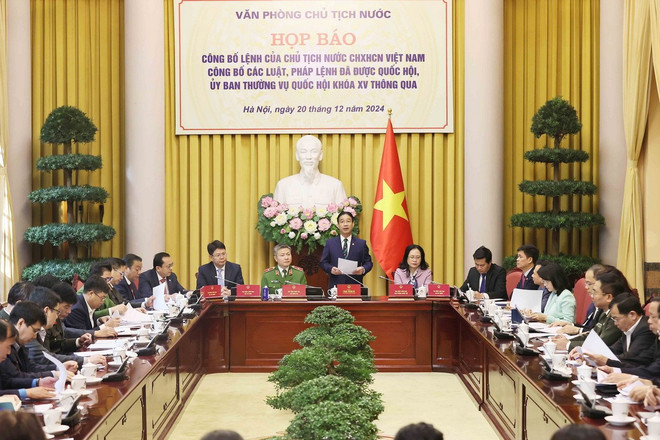

[LEGAL UPDATE] The Presidential Order announces the promulgation of Law No. 56/2024/QH15.

Views: 1238

Among the 9 Laws recently passed by the National Assembly, Law No. 56/2024/QH15 amends and supplements 9 Laws under the Ministry of Finance, including the Law on Securities; the Law on Accounting; the Law on Independent Auditing; the Law on State Budget; the Law on Management and Use of Public Assets; the Law on Tax Administration; the Law on Personal Income Tax; the Law on National Reserves; and the Law on Handling Administrative Violations. The Law consists of 11 articles, amending and supplementing 25 articles of the Law on Securities, 9 articles of the Law on Accounting, 7 articles of the Law on Independent Auditing, 8 articles of the Law on State Budget, 31 articles of the Law on Management and Use of Public Assets, 14 articles of the Law on Tax Administration, 2 articles of the Law on Personal Income Tax, 5 articles of the Law on National Reserves, and 2 articles of the Law on Handling Administrative Violations.

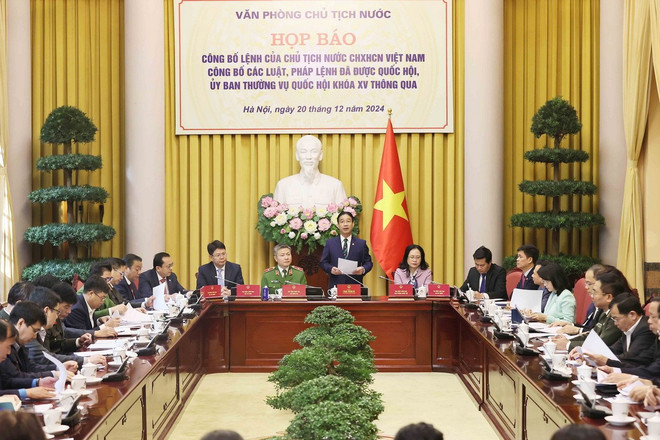

Comrade Phạm Thanh Hà – Deputy Chief of the Office of the President announced the Order of the President.

Law No. 56/2024/QH15 consists of 11 articles, regulating key contents such as:

-

Securities Law: Supplementing and specifying the concept of stock market manipulation; regulations on professional securities investors; responsibilities of organizations and individuals related to records and reports concerning securities and the securities market activities; private securities offerings, etc.

-

Accounting Law: Simplifying documentation requirements while ensuring management needs; supporting digital transformation activities; enhancing State management capacity in accounting; and protecting the legitimate rights and interests of accountants.

-

Independent Audit Law: Specifying individuals prohibited from registering as practicing auditors and continuing as practicing auditors; addressing violations of independent audit laws; strengthening the effectiveness and efficiency of State management in independent auditing; and improving audit quality.

-

State Budget Law: Amending and supplementing provisions regarding tax refunds, enforcement of administrative decisions on tax management; tax declaration and calculation in e-commerce and digital platform-based business activities; and applying modern information technology and techniques.

-

Law on Management and Use of Public Assets: Authorizing the Government to decide the allocation and use of undistributed central budget funds and allowing local People's Committees to decide on undisbursed local budget capital; supplementing regulations for using state budget expenditures for certain tasks from both investment and recurrent expenditure sources while delegating specific regulations to the Government.

-

Tax Management Law: Promoting decentralization and improving efficiency in the management and use of public assets; revising regulations on the maintenance and repair of public assets; supplementing regulations on the transfer of public assets, infrastructure assets to local management; and procedures for handling assets established as all-people's ownership.

-

National Reserve Law: Adding objectives for national reserves and supplementing or abolishing some responsibilities and powers of the National Assembly, the Standing Committee of the National Assembly, the Government, and the Prime Minister.

-

Personal Income Tax Law: Adding tax responsibilities for organizations managing e-commerce platforms, digital platforms with payment functions, and other organizations involved in digital economy activities.

-

Law on Handling Administrative Violations: Amending provisions related to the statute of limitations for administrative violations.