LEGAL UPDATE: GUIDE TO IMPLEMENTING ELECTRONIC IDENTIFICATION FOR FOREIGNERS

Views: 1640

.png)

From July 1, 2024, enterprises with only a legal representative who is a foreigner will need to implement level two electronic identification to be able to activate electronic identification for the enterprise and from there can use the online public services of the enterprise. Accordingly, in order to support clients to complete this procedure quickly and in accordance with regulations, ALTAS would like to send instructions to follow the following steps:

Step 1: Registering a Personal Mobile Number

Foreign nationals (“Foreigners”) must register a personal mobile number under their own name with the telecommunications service provider they are using. Procedures may vary slightly depending on the provider; however, the general process requires Foreigners to personally visit the provider’s service center with their passport to complete the registration.

Step 2: Registering a Level 2 e-ID Account at the Immigration Department

2.1. Required Documents

The following documents must be prepared:

Required Documents

|

No.

|

Documents

|

Format

|

01

|

Application form for e-ID account (Form TK01)

|

Original

|

02

|

Foreigner’s passport

|

Original

|

03

|

Foreigner’s temporary residence card

|

Original

|

04

|

Mobile phone with the registered SIM

|

N/A

|

2.2. Detailed Procedure at the Immigration Department

-

Queue and Pay for ID Photo: Obtain a queue number to take a portrait photo and pay the ID photo fee (VND 30,000).

-

Take ID Photo: Have the Foreigner’s ID photo taken at the Immigration Department.

-

Proceed to Document Verification: After the photo, queue for document verification, obtain a new queue number, and provide the following information:

-

Permanent address in Vietnam (as per the new administrative unit);

-

Registered personal mobile number;

-

Contact email.

-

Submit and Authenticate Documents:

-

When called, the officer will input the provided information into the e-ID system.

-

The Foreigner’s fingerprints will be collected for verification against the national immigration database.

-

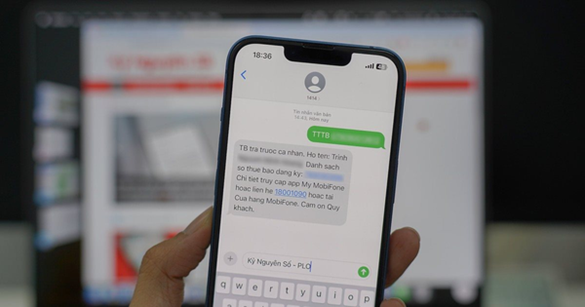

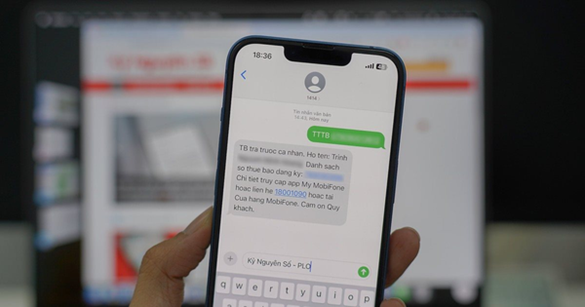

The mobile number will be verified by sending an SMS with the syntax TTTB [Passport Number] to 1414 from the registered mobile number.

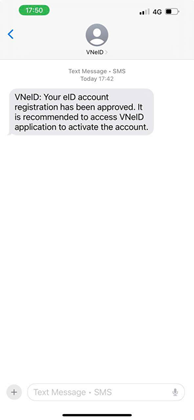

Result returned after verifying the registered phone number:

-

Complete Form TK01: The officer will fill in Form TK01; the Foreigner must review the information and sign for confirmation.

-

Submit Application: The Immigration Department will forward the e-ID account application to the e-ID management and authentication authority.

-

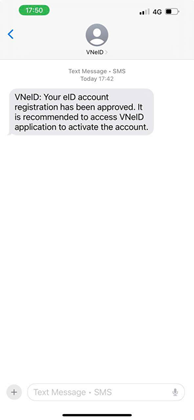

Receive Notification: The e-ID management and authentication authority will notify the result via the Foreigner’s mobile number.

-

Activate Personal e-ID Account: Upon receiving the e-ID code via notification, the Foreigner must activate their personal e-ID account on the VNeID application.

The result will be sent via message in the following format:

Step 3: Registering an e-ID Account for the Enterprise

3.1. Registering the Enterprise’s e-ID

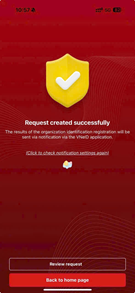

After successfully activating the Level 2 personal e-ID account, the Foreigner can log into the VNeID application and follow the steps to register the e-ID for their organization.

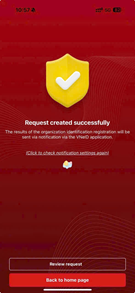

Select the 'Enterprise Identity Registration' section on the VNeID account and follow the instructions as guided.

|

|

Once the registration is submitted, the result will appear as shown in the image, and you will need to wait for the competent authority to verify the application.

|

|

3.2. Delegating Authority

Once the enterprise’s e-ID is successfully registered, the Foreigner can proceed to delegate authority to designated individuals to handle the enterprise’s internal procedures.

Processing Time

(1) For registering a Level 2 e-ID account for Foreigners: 3 to 7 working days from the date of successful registration at the Immigration Department.

(2) For registering an e-ID account for the enterprise: 3 working days to 15 calendar days from the date of submitting a valid application. If additional information or amendments are required, the management authority will send a notification through the registered e-ID account.

How ALTAS Can Assist You:

ALTAS LAW is uniquely positioned to assist your business in navigating these complex administrative reforms. We offer a comprehensive suite of legal and business services designed to provide seamless support during this transition period:

• Accounting and Tax Services: We also offer accounting and tax services to help your business manage the financial implications, including tax planning, tax settlement, tax auditing and tax refund.

• Licensing & Regulatory Compliance: We will meticulously review your existing licenses and permits, advise on necessary amendments or renewals, and guide you through the process of obtaining any new approvals. Our team will also ensure your compliance with all relevant regulatory changes.

Please feel free to reach us via email contact@altas.vn to discuss your specific concerns and explore how we can navigate these reforms successfully.

--

Prepared by:

Lawyer Partner at ALTAS Law - Mr. Le Quang Lam & Senior Legal Associate at ALTAS Law - Tran Anh Hoang

Date: July 18, 2025

.png)

![[LEGAL NEWSLETTER – NOVEMBER 2024 ] CIRCULAR NO. 48/2024/TT-NHNN [LEGAL NEWSLETTER – NOVEMBER 2024 ] CIRCULAR NO. 48/2024/TT-NHNN](thumbs/210x144x1/upload/news/web-1666620014958786336308-16708409830151046155074-4017.jpg)

![[MARKET NEWS - NOVEMBER 2024] KEY CHANGES IN KARAOKE AND NIGHTCLUB BUSINESS OPERATIONS [MARKET NEWS - NOVEMBER 2024] KEY CHANGES IN KARAOKE AND NIGHTCLUB BUSINESS OPERATIONS](thumbs/210x144x1/upload/news/pho-di-bo-bui-vien-cover-5284.webp)